CREDIT AGRICOLE BANK NETWORK TRANSFORMATION

Studying the problem, we needed to create a concept that not only met the goals and needs of the bank but could also reflect the needs of various locales and their clientele. Accordingly, the bank required this network transformation program to embrace the underlying concept of personalized service, confidentiality, transparency and professional expertise. Digital banking and technology are also considered in the concept’s clean, modern design.

As we dug into this project, we realized that simply redesigning branches wouldn’t be enough. To put the client first, our concept needed to address both emotional and rational factors affecting customer interaction in the branch. Communications, organization of the various modules within the branch and customer flow were analyzed and then addressed.

In the final concept, the emotional attributes of individuality, rapport, significance, care, convenience, and confidence work together with the rational attributes of functionality, improved process ability and enhanced comfort and are reflected in each of the factors contributing to superior customer service.

Problem Backgrounder

Think about how smart phones and digital technology have changed your life. Most of us will agree that technology has changed how we live and work exponentially. Now, imagine you are a bank trying to remain viable as the banking industry faces new competitive challenges daily – including those of digital banking. For the banks, still around after the global financial crisis of 2007-2008, change was not only necessary, but demanded by regulators and customers alike. The fallout sent brand trust for the banking industry to levels not seen since the Great Depression. Fostering customer relationships to rebuild trust was imperative.

Crédit Agricole is one such bank. With a rich history in France, dating back to the late 19th century, Crédit Agricole has seen its share of change and transformation. The financial crisis prompted them to reevaluate once again.

After an extensive survey, Crédit Agricole (CA) created an entirely new concept for the brand, that of a universal and client centric bank. In 2016, they announced a new tagline: “Crédit Agricole: A Whole Bank Just for You.”

What does a “whole bank” involve? To CA, it means that everyone cooperates and collaborates to serve each customer. “Just for you” means a premium level of service is provided to each customer, no matter what their stature.

A new tagline is only one piece of this financial institution’s client centric overhaul. They had a goal to redesign their entire process of customer service, one that included a new concept for their physical banking branches. This is where we came in as a business consultant and creative thinker.

Duplicating Success

Another problem we faced was that as each branch was built or remodeled, the local project manager most likely wouldn’t be knowledgeable in the construction field. Therefore, predicting problems during construction and capably optimizing time and budget could be difficult for them. How could we help the bank to efficiently and successfully follow the concept at different locations?

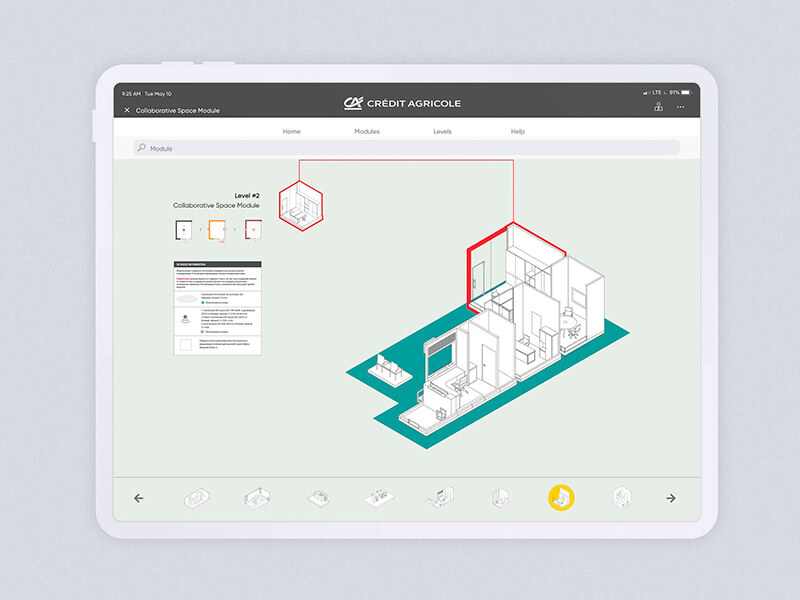

While supervising the pilot branch, we drew up a new design approach, Modules Guidelines, that organizes not only all the modules of the branch with a three-level system but provides a module’s schedule and describes the basic principles of customer service for each module and module functioning. The Modules Guidelines are easily followed, which allows the bank’s project manager to easily communicate directly with subcontractors and an outsourced architect (if needed). Because new or branch remodels are expensive, by utilizing the Modules Guidelines, flexibility and efficiency of the buildout is increased, reducing construction expenses as well as minimizing unforeseen expenses.

This new standard will help Crédit Agricole build trusted relationships with their clients, because it is based on customer and employee needs. Customers are treated to a fresh approach of service through special zoning, interior organization, and innovations relating to the range of services and customer flow.

Facts and Figures

Many financial experts have questioned the value of a physical bank branch with the growing popularity of mobile and digital banking. However, recent articles and studies suggest that branches are still necessary, but an overhaul of their function and design is necessary.

For instance, in a white paper by global consulting firm PwC, Retail Banking 2020 Evolution or Revolution?, they state that branches should “Encourage self-service for routine matters, and refocus branch and contact center staff on higher value-added activities like relationship building and sales.” They further assert that “leading banks” are “designing their branch strategies to deliver a differentiated experience, based on customer needs, the competitive landscape, brand promise and internal capabilities.”

As with any of our projects, we hope our concept for Crédit Agricole solved a problem that will take them well into the future. We are both pleased and humbled that the creative thinking that went into this network transformation concept was validated when it won a FinAward 2018 in the category “Best Bank Branch.” This honor was awarded to Crédit Agricole Bank at the UNIT Fintech Forum 2018.